Company Vehicle Accident Lawyer 2025: Expert Guide

Fort Lauderdale: Why Company Vehicle Accidents Are More Complex Than Regular Car Crashes

A company vehicle accident lawyer handles crashes that involve commercial vans, delivery trucks, work pickups, and other business-owned cars. These claims aren’t just “bigger fender-benders” – they follow a very different rulebook than a regular collision in Fort Lauderdale.

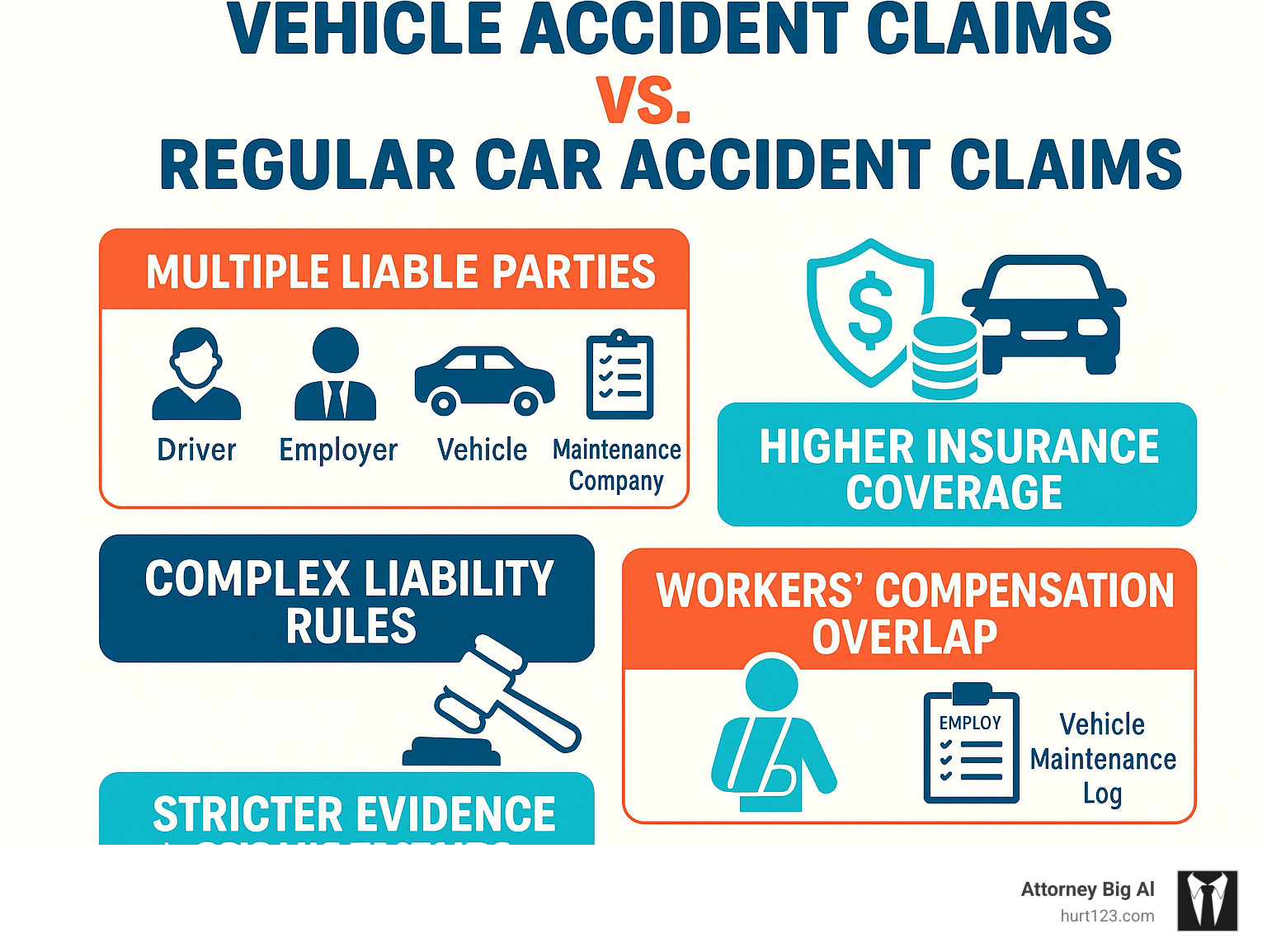

Key differences from a normal crash:

- Multiple liable parties – the driver, employer, leasing company, and maintenance contractor may all share fault

- Higher insurance limits – commercial policies often start at $1 million

- Complex liability rules – doctrines like respondeat superior decide when a company pays for an employee’s mistakes

- Overlap with workers’ compensation – injured employees may have two claims running at once

- Evidence disappears quickly – electronic logs and maintenance records can be deleted in days, not months

When a business vehicle slams into you on Broward Boulevard, the stakes rise immediately. More insurance money might be available, but insurers fight harder to protect those dollars. Add Florida’s two-year lawsuit deadline and you can see why quick action matters.

Need a deeper dive into commercial crashes? Check out:

Who is Liable? Unpacking Fault in a Hollywood Company Vehicle Accident

When you’re involved in a company vehicle accident in Hollywood, figuring out who’s responsible can feel like solving a puzzle with multiple pieces. Unlike a typical car accident where you’re usually dealing with one at-fault driver, company vehicle crashes often involve several parties who might share the blame.

Think of it this way: when a delivery driver runs a red light and hits you, the driver is obviously at fault. But what about the company that employed them? What if the vehicle was poorly maintained? What if the driver was rushing because of unrealistic delivery deadlines? Suddenly, you’re looking at multiple potential defendants who might owe you compensation.

The at-fault driver is typically the first person we look at – they’re the one who actually caused the crash. But in company vehicle cases, the employing company often bears responsibility too. Sometimes the vehicle owner is a separate entity if the company leases their fleet. Maintenance companies can be liable if mechanical failure contributed to the accident. Even cargo loaders might share fault if improperly loaded goods caused the driver to lose control.

This is where having a company vehicle accident lawyer becomes crucial. We know how to investigate all these potential sources of liability and make sure you’re not missing out on compensation from any responsible party.

Understanding ‘Respondeat Superior’ and Employer Liability

Here’s where things get interesting from a legal standpoint. There’s an old Latin legal principle called “respondeat superior” – which basically means “let the master answer.” In plain English, this means employers are responsible when their employees mess up while doing their jobs.

This vicarious liability doctrine is incredibly important in company vehicle cases. It means that even if the company did nothing wrong directly, they’re still on the hook for their employee’s negligence. But there’s a catch – the employee has to be acting within their job duties when the accident happens.

Let’s say a pizza delivery driver is making their last delivery of the night and rear-ends you at a stoplight. The pizza company is likely responsible under respondeat superior because delivering pizza is exactly what they hired the driver to do. But if that same driver decides to visit their friend across town after work and causes an accident on the way, the company probably isn’t liable.

Proving employment status can get tricky, especially with today’s gig economy. We dig into employment agreements, tax records, and how much control the company had over the driver’s work. The more control the company exercised, the more likely they are to be responsible.

The scope of employment question isn’t always black and white. Personal errands versus work tasks can blur together. If an employee stops for coffee on their way to a client meeting, are they still “on the job”? These nuances can make or break your case.

What is Negligent Hiring or Entrustment by an Employer?

While respondeat superior makes employers responsible for their employees’ actions, negligent hiring and entrustment are about the employer’s own mistakes. This is direct negligence versus vicarious liability – the company screwed up directly, not just through their employee.

Negligent hiring happens when a company should never have hired someone to drive in the first place. Maybe they didn’t bother checking if the driver had a valid license. Maybe they ignored a driving record full of accidents and violations. Maybe they hired someone with a DUI conviction to drive a delivery truck.

Negligent entrustment is when the company knows they have an unfit driver but lets them keep driving anyway. Perhaps the driver has been in multiple accidents since being hired, or coworkers have complained about their reckless driving, but the company doesn’t take action.

To prove these claims, we need to show the company knew or should have known about the driver’s poor driving record or lack of proper training. This often means digging into employment files, training records, and company policies around driver safety.

Proving the employer’s knowledge is key. We look for background check records, previous incident reports, and any complaints about the driver’s performance. Sometimes we find that companies cut corners on driver screening to save money – and that’s when inadequate supervision becomes a serious problem.

These claims can be particularly valuable because they may open the door to punitive damages – extra money meant to punish companies for particularly reckless behavior. When a company knowingly puts a dangerous driver on the road, they should face consequences beyond just paying for the damage they caused.

Your First Steps and Legal Deadlines After a Crash in Miami

Getting hit by a company vehicle in Miami can leave you shaken and unsure what to do next. The adrenaline rush, the confusion, the worry about injuries – it’s completely natural to feel overwhelmed. But the steps you take in those first crucial moments can make all the difference in your ability to get fair compensation later.

Your safety is the only thing that matters right now. Take a deep breath and focus on making sure you and everyone else are okay. Company vehicle accidents often involve larger vehicles with more force behind them, so injuries can be more serious than they initially appear.

Unlike a typical fender-bender between two personal cars, company vehicle crashes come with extra complications. There might be multiple insurance companies involved, additional reporting requirements, and complex questions about who’s actually responsible. A company vehicle accident lawyer can help steer these complications, but first, you need to protect yourself at the scene.

Florida law gives you two years from the accident date to file a personal injury lawsuit. That might sound like plenty of time, but company vehicle cases require extensive investigation. We need to dig into employment records, vehicle maintenance logs, and corporate policies – all of which takes time to obtain.

What to Do Immediately After the Accident

The moments right after an accident can feel like a blur, but staying focused on these key steps will protect your rights and your health.

Start by checking for injuries – both your own and others involved. Even if you feel fine, adrenaline can mask pain and delayed injuries like whiplash often don’t show up for hours or even days. When in doubt, ask the paramedics to check you over.

If the vehicles are drivable, move them out of traffic and turn on your hazard lights. Your safety is more important than preserving the exact accident scene. Just make sure to take photos first if you can do so safely.

Call 911, especially if anyone is hurt or if there’s significant damage. The police report will be crucial evidence later, and having an official record helps establish what happened.

Get information from the other driver – their name, license number, insurance details, and importantly, their employer’s information. If they’re driving a company vehicle, you’ll need to know who they work for and whether they were on the job when the accident happened.

Document everything with photos – the damage to all vehicles, the accident scene, license plates, street signs, and any visible injuries. Take more photos than you think you need. Your phone is your best friend here.

Talk to witnesses and get their contact information. Independent witnesses can be incredibly valuable if there’s a dispute about what happened later.

Don’t admit fault or apologize – even if you think you might have contributed to the accident. Saying “I’m sorry” is natural, but it can be used against you later. Stick to the facts about what you observed.

Contact your insurance company to report the accident, but keep your statement factual and brief. You’re required to report it, but you don’t need to speculate about fault or give a detailed statement right away.

Company vehicle accidents have some unique considerations. Make sure you get the company name and contact information, note any logos or vehicle identification numbers, and ask whether the driver was working at the time. If there’s cargo or equipment that might have contributed to the accident, photograph that too.

Reporting the Accident and Filing a Claim in Florida

Florida has specific reporting requirements that you need to follow, and missing these deadlines can complicate your case. The state requires you to report to the DMV within 10 days if the accident caused injury, death, or property damage over $1,000.

The police report should be filed at the scene or within 24 hours if officers don’t respond immediately. Your DMV report using form SR-1 must be submitted within 10 days. Insurance claims should be filed as soon as possible after the accident, and personal injury lawsuits must be filed within two years.

Here’s where company vehicle accidents get tricky – you might be dealing with multiple insurance companies. The driver could have personal auto insurance, while their employer carries commercial liability coverage. Sometimes the company leases vehicles, adding another insurance layer. Figuring out which policy applies and how they interact requires careful analysis.

Don’t wait to get legal help. Insurance companies start investigating immediately, and they have teams of adjusters and lawyers working to minimize what they pay out. Having a company vehicle accident lawyer on your side early means critical evidence gets preserved and your rights are protected from day one.

The insurance companies aren’t going to wait around, and neither should you. The sooner you get professional help, the better your chances of getting the full compensation you deserve.

How a Company Vehicle Accident Lawyer in Boca Raton Builds Your Case

When you’re hurt in a company vehicle accident in Boca Raton, building a winning case requires detective work that goes far beyond a typical car crash. A company vehicle accident lawyer must dig deep into employment relationships, corporate policies, and commercial insurance coverage to get you the compensation you deserve.

The investigation process starts immediately after we take your case. We gather the usual evidence like police reports, witness statements, and photos, but that’s just the beginning. We also need to obtain employment records to prove the driver was working when the accident happened, vehicle maintenance logs to see if poor upkeep contributed to the crash, and company training records to determine if the employer properly prepared their driver.

Black box data is often crucial in company vehicle cases. Many commercial vehicles have electronic logging devices that record speed, braking patterns, and other critical information. This data can make or break your case, but it gets overwritten quickly. That’s why we move fast to preserve this evidence before it disappears forever.

We also examine the company’s safety policies and hiring practices. Did they do background checks? Was the driver properly trained? Were there previous complaints about this driver that the company ignored? These details can reveal whether the employer was negligent in ways that go beyond just the accident itself.

Dealing with commercial insurers is a whole different ballgame than handling personal auto claims. These companies have experienced adjusters who know the stakes are higher and will fight harder to protect their bottom line. We understand their tactics and how to counter them effectively.

Seeking Compensation for Your Injuries and Losses

Company vehicle accidents often cause more serious injuries because commercial vehicles are typically larger and heavier than passenger cars. The good news is that commercial insurance policies usually have much higher coverage limits than personal auto insurance.

Economic damages cover your actual financial losses. This includes medical bills for your current treatment, future medical care you’ll need during recovery, and lost wages from time off work. If your injuries affect your ability to earn money long-term, we also pursue reduced earning capacity damages.

Non-economic damages compensate you for the harder-to-measure impacts of your accident. Pain and suffering damages account for the physical discomfort and emotional distress you’ve endured. Loss of enjoyment of life covers how your injuries have affected your ability to participate in activities you once loved.

In some cases, punitive damages may be available if the employer’s conduct was particularly reckless. For example, if a company knowingly put an unfit driver behind the wheel or consistently ignored safety violations, the court might award punitive damages to punish this behavior.

The key advantage in company vehicle cases is the insurance coverage. While a typical personal auto policy might have $25,000 to $100,000 in coverage, commercial policies often provide $1 million or more. This means there’s usually enough money available to fully compensate you for serious injuries.

How a Company Vehicle Accident Lawyer Handles Insurance Companies

Commercial insurance adjusters are typically more experienced and aggressive than those handling regular car accident claims. They know the higher stakes involved and will use every trick in the book to minimize what they pay out.

We protect your rights by handling all communications with insurance companies so you don’t accidentally say something that hurts your case. We also make sure all deadlines are met and that your claim moves forward properly through the system.

Insurance companies often try to claim the driver was outside the scope of employment when the accident happened, hoping to avoid liability altogether. They might also argue that you were partially at fault or offer quick, low-ball settlements before you understand the full extent of your injuries.

Our experience with commercial insurers allows us to anticipate these tactics and build a case that maximizes your recovery. We understand what motivates insurance companies to settle fairly and how to apply the right pressure to get results.

When negotiations aren’t enough, we’re prepared to take your case to court. The litigation process can be lengthy, but sometimes it’s the only way to get the full compensation you deserve. Having a lawyer who’s willing to go to trial often motivates insurance companies to make better settlement offers.

Sunrise Scenarios: When You’re the Employee or Workers’ Comp is Involved

Getting hurt while driving for work puts you in two legal lanes at once.

- Workers’ compensation – pays medical bills and a portion of lost wages, no matter who caused the wreck.

- Third-party car accident claim – lets you pursue the at-fault driver (or company) for the rest: full wage loss, pain, suffering, and future costs.

A company vehicle accident lawyer coordinates both claims so they don’t trip over each other. We report your injury on time, steer you through employer-approved doctors, and negotiate the workers’ comp lien so it doesn’t swallow your personal-injury settlement.

Florida law bars employer retaliation for filing comp, and you may qualify for light-duty or retraining programs. Move fast, though – missed deadlines can erase benefits before they start.

Sunrise FAQs: Answers to Common Questions about Company Vehicle Accidents

What usually causes these crashes?

Deadlines and distraction. Speeding to make deliveries, checking a work app while driving, skipped brake repairs, and driver fatigue lead the list in Sunrise.

How does the lawyer get paid?

We work on a contingency fee – no attorney fee unless we recover money for you. If we win, our fee is a set percentage spelled out in writing. We also advance case costs so you pay nothing up front.

How are company vehicle claims different from regular ones?

More defendants, bigger insurance limits, corporate safety rules, and possible workers’ comp overlap make the legal puzzle tougher – and the potential compensation larger.

Fort Lauderdale to Sunrise: Securing Your Rights and Your Recovery

Corporate insurers begin circling the wagons within hours of a crash. While you attend medical appointments, they comb through evidence looking for ways to pay less. Don’t give them a head start.

Attorney Big Al has offices in Fort Lauderdale, Hollywood, Miami, Boca Raton, Sunrise, and West Palm Beach, giving us local reach with statewide muscle. Our contingency model means you owe no attorney fee unless we win.

Ready to push back against the insurance playbook? Learn your options for a car accident claim and schedule a free consultation today. Focus on healing – we’ll handle the paperwork and the pressure.